March 05, 2005

Mathematical Constructivism and Proofs in Economics

Steve Han asks me what I think of Mathematical Constructivism, described in this Wikipedia entry. As the entry describes well, there are four parts to Mathematical Constructivism: (1) if you are proving that a class of things exists, you have to actually find one example in the class that does exist, (2) if you are proving that a property is true for every element of a class of things, you have to provide an algorithm that will show it is true for every individual element, (3) the concept of infinity can't be used, and (4) you can't use proofs by contradiction (something which flows from principles 1 and 2).I remember first hearing of this in Herb Scarf's math econ class at Yale around 1978. Brouwer was a constructivist, and Scarf was happy that in the Scarf Algorithm for finding fixed points he had found a constructive proof of Brouwer's Fixed Point Algorithm.

I use proofs by contradiction all the time, and do believe that they indeed lead me to truth. That is because I would define a true statement as one on which we can rely under all circumstances and to which everyone would agree if they thought hard and long enough. I do not, however, think that proofs by contradiction lead me to understanding. I can rely on my proved theorem, but I do not necessarily understand it, by which I mean that I cannot generalize it further or extend it to even slightly different premises (unless I can be assured that the contradiction carries over to those different premises).

Thus, knowledge attained via proofs by contradiction is useful but unsatisfactory. It is okay for theorems that one uses as a technical tool, but not for ultimate conclusions. (Maybe I'm caught in a contradiction here-- how can I rely on an ultimate conclusion reached by a technical tool that I don't understand?)

Take, for example, the question of existence of a Nash equilibrium in a particular game-- say, the Battle of the Sexes. Here are three ways I could prove that an equilibrium exists:

2. I could show that this game (with mixed strategies included) fits the premises of the standard theorem about when equilibrium exists-- that the game's payoffs are closed and bounded, that the payoff functions are continuous in the strategies, and so forth.

3. I could in effect re-prove an existence theorem by showing that a contradiction arises if no equilibrium exists. (Is it true that whenever a Proposition is true, one can find a proof of it by contradiction? Probably.)

1. I find a strategy profile that fits the definition of equilibrium-- that is, such that neither the Man nor the Woman would unilaterally deviate. One such strategy profile is that both players go to the Prizefight. The Man would not deviate, because he likes the Prizefight better than the Ballet and he likes being with the Woman. The Woman would not deviate, because although she likes the Ballet better, it is more important to attend the same event as the Man.

For this simple situation, method (1) is easiest and best. I not only achieve my goal of proving existence, but I end up with an example of it too. I understand the situation much better than if I had used (2) or (3).

More often, method (1) is not easiest, because it is hard to find an example but easy to show that the conditions of some other theorem apply, method (2). But method (1) still yields the best understanding, I think.

In economic modelling, understanding is particularly important. Our models are always special cases anyway, and we want to extend the mathematical conclusion to the real world. Thus what we call "intuition" is crucial. It is not enough to do the proof: the economist must make the reader understand why the general idea behind the proposition is true. The proof is there mainly to provide a check on the intuition, because purely verbal explanations are more likely to be flawed.

An example is the Walras-Arrow-Debreu proposition that there exists a set of prices which equate supply and demand. The premises of the theorem never apply exactly, but frequently apply approximately. The proof is a useful achievement, but what is most important is the idea that the Invisible Hand works, an idea as old as Adam Smith, but one which in the form he presented it would leave any careful reader uncomfortable.

Permalink: 09:27 AM | Comments (0) | TrackBack

February 28, 2005

Mansfield on Economists; The Summers-Harvard Controversy

Harvey Mansfield says in The Weekly Standard:That is well put. Economics is the Dismal Science because it makes tradeoffs, and makes them explicitly: "Do you want 10 more dead babies, or 20 more dead teenagers?" Perhaps because we are accustomed to switching back and forth between words and mathematical notation anyway, we are more indifferent than most people to labels. It is liberating: if you don't need to worry about whether somebody will find your language insensitive, you can get down to the business at hand undistracted.At the meeting many said that the issue was not academic freedom vs. political correctness, as portrayed by the media, but Summers's style of governing. The point has a bit of truth. Summers is an economist, and there is almost no such thing as a suave economist. The great Joseph Schumpeter, a Harvard economist of long ago, claimed to be the world's greatest lover as well as the world's greatest economist (it is said), but he was a singular marvel. The reason why economists are blunt is that words of honey seem to them mere diversion from reason and self-interest, which are the only sure guides in life.

Also, economists are used to piercing disguises to find reality, and so we find attempts by scholars to use transparent disguises insult our intelligence. When a businessman says, "I want high prices so the consumer will not have to suffer from low quality discounters," we hear "I want high prices so I will make a lot of money at the expense of consumers," and that's what we repeat, despite the pleas of the businessman that profit was the furthest thing from his mind and that we are slandering him.

As a result, there is more freedom of thought in economics than in most disciplines. We are used to discussing all possibilities, and we are scholarly enough to know that someone may be exploring an idea out of intellectual curiosity rather than because it fits his political objectives. Whether we agree with him or not, we think that Richard Posner's idea of auctioning off babies for adoption is worth discussing, and that it would be the height of anti-intellectualism to say he shouldn't even bring up such an idea.

This makes us, I think, more tolerant of non-economic ideas too. If Ward Churchill wants to argue that the 9-11 victims deserved his fate, by all means let him argue that. Maybe he is correct and maybe not, but the idea can't be ruled out until we hear his reasons-- though, of course, our willingness to listen will depend on our estimate of how likely it is that the speaker has something intelligent to say. It is not that we are closed-minded; just that we know we need to ration our time.

Mansfield's assessment of economics is wonderful because it is both correct and concisely yet poetically critical. Much could be extracted from that sentence.

Permalink: 11:31 AM | Comments (0) | TrackBack

February 22, 2005

Interest Rates: Inflation-Indexed Bonds, Risk Premia

These interest rates from today's WSJ may be useful for thinking about social security reform: Inflation-indexed US 2007 bond: .7%Inflation-indexed US 2032 bond: 1.8%

Merck 2015 bonds spread over US bond: .7%

GE Capital 2012 bond spread over US bond: .4%

GM 2033 bond spread over US bond: 3.7%

Metlife 2034 bond spread over US bond: .9%

Permalink: 10:34 AM | Comments (0) | TrackBack

February 15, 2005

Reasons for Social Security Refuted

The two common justifications given for social security are that (a) without social security, old people would be poor, and (b) we need to force people to save for the future lest in their old age they starve or go on public charity. Neither of these reasons justifies a program like the one we have, where all income-earners are taxed in their youth and paid pensions in their old age. . . .. . . Reason (a) is a reason to have public charity include old people who cannot work as well as young people who cannot work. As far as I know, that is currently the case. Thus, we don't need social security for it.

Reason (b) is, at most, a reason to make sure that everybody who can save does save for their old age. I would say, myself, that if someone could have saved for their old age and didn't, then we simply should not put them on public charity.

But suppose we don't want to make people pay the penalty for their improvidence. Even then, reason (b) doesn't apply to most people, because most people *do* save, even in addition the forced saving of Social Security, and they would save even more if Social Security. Most people save, if only in the form of owning a house (which they could sell in their old age) or by means of an employee pension plan. At a minimum, Social Security should exempt all of those people from paying tax or getting benefits. We do not need to force Bill Gates to provide for his old age. Going a step further, another common way to provide for old age is to have children. Someone with eight children should not have to worry about starving in their old age. If we do not already, we should require that children maintain their old parents, just as we require parents to maintain their young children. And we should exempt someone with children from being in the Social Security system. They have invested for their old age in raising children. And in their old age, their own children should pay taxes for their pensions, not other people's children.

Going two steps further, for the few eligible people left, why require them to do their forced savings via a low-yield government program? All that is necessary is to force them to contribute to a pension plan, much as in the private-account plans. Going three steps further: how many of the improvident who would not save for their old age actually would reach old age? If someone is reckless enough not to save, maybe he will die early in one of numerous ways (shootings, accidents, drink, drugs, AIDS) that affect reckless people. In fact, if you plan to burn yourself out by age 40 it is irrational to invest in a pension plan.

Little mentioned is the corrupting moral effect of Social Security. For one thing, it encourages improvidence, because a person can count on a government pension even if he saves nothing himself. For another, it encourages filial impiety. Instead of caring for my parents myself, I can shrug them off as the government's responsibility.

Permalink: 01:20 PM | Comments (2) | TrackBack

January 31, 2005

Tax Transaction Costs; Lederman Sources

Professor Lederman did a useful follow-up of the topic of our law-and-econ lunch last week, which was the transaction cost of taxation. Here are some facts:The IRS budget is around $10 billion, http://www.irs.gov/pub/irs-utl/budget-brief-05.pdf.

IRS collected nearly $2 trillion in revenue in 2003: http://www.irs.gov/irs/article/0,,id=98141,00.html.

IRS reports that it costs taxpayers 48 cents per $100 collected: http://www.irs.gov/irs/article/0,,id=98141,00.html. The site doesn't say, on the front page, what this means. I think it means the IRS's budget cost, 10 billion divided by 2000 billion dollars. Taxpayer costs and allocative distortion would be much higher.

IRS Data Books for 2001-2003, which contain a variety of interesting statistics, are available at http://www.irs.gov/taxstats/article/0,,id=102174,00.html.

Permalink: 02:52 PM | Comments (0) | TrackBack

Shareholders vs. Directors as Owners of the Firm; Bainbridge

From what Professor Thomas Smith says, Professor Bainbridge's UCLA conference on corporate law was a great success, with interesting papers and a crowd of interesting and diverse people like Hart and Presser. Why wasn't I invited? (maybe because I've never written a paper on corporate law and don't even have any related papers in progress.) But I can see some of the papers at ALEA in New York in May, most likely.

In his blog Bainbridge

says:...

...

Lynn Stout’s presentation forcefully makes the case for what she and I have

taken to calling "director primacy": i.e., the idea that the corporation is a

vehicle by which directors hire factors of production and the corollary

proposition that shareholders have only the very limited set of control of

rights for which they have bargained.

...

The other axis along which the shareholder primacy debate plays out relates to

the ends of corporate governance. What is the decisionmaking norm that guides

corporate governance? At one end of that axis lie folks like myself who believe

that Dodge v. Ford Motor Co. meant what it said; namely, that the end of

corporate governance is shareholder wealth and that the discretion of directors

must be exercised towards that end.

(A blogging note: It would be nice if Bainbridge (and Reynolds, and others)

had Weblog RA's. The RA would be told to scan the blog several times a day and

links intelligently. In the post above, the RA would add links to Stout's paper,

Bainbridge's paper, and Dodge v. Ford.)

I see a problem, so obvious that no doubt Bainbridge's journal articles deal with it: if the corporation is the directors', not the shareholders', why should the directors maximize shareholder wealth rather than their own wealth? I suppose the answer is that what Bainbridge means is that the deal between shareholders and directors is that the directors will act like trustees, maximizing shareholder wealth, but as the directors, not the shareholders, see fit. That's fine-- it's like the idea of republican instead of democratic government (small r and d), with the elected officials doing what they believe is right rather than what they believe the voters want. Burke, I think, took that view in a piece titeld something like "A Letter to the Electors of Bristol".

That is different, though, from the notion that the directors simply hire all the factors of production for their own benefit, including hiring capital from shareholders. If that were so, then the directors would be residual claimants. They would have to reward shareholders enough to make them buy risky shares, but if the corporation were unusually well run, well enough to have extraordinary profits, the directors would keep the excess.

Now I am starting to think that maybe that notion is correct, though. It looks like it would lead to efficient production. And it might fit reality-- with the directors being pretty safe from litigation, even if they self-deal or pay excesssive managerial salaries, so long as the shareholders do OK and are kept pretty happy. I'd have to do a formal model, I think, to figure it out.

Permalink: 02:10 PM | Comments (0) | TrackBack

January 25, 2005

Adam Smith on the Invisible Hand and Wealth Maximization

Here is the famous passage from Adam Smith's Wealth of Nations on "the invisible hand" ( B.IV, Ch.2, Of Restraints upon the Importation from Foreign Countries):Notice that he explicitly uses a criterion close to the "wealth maximization" standard in economics. (See the "Notes on Value Maximization" that I just wrote for class.)As every individual, therefore, endeavours as much as he can both to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value; every individual necessarily labours to render the annual revenue of the society as great as he can . He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for the society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good. It is an affectation, indeed, not very common among merchants, and very few words need be employed in dissuading them from it.

Permalink: 02:10 PM | Comments (0) | TrackBack

January 15, 2005

The Trade Deficit as a Result of an Aging Europe and China

Professor Michael Pettis' WSJ op-ed " Deficit Attention Disorder" ($) calls attention to an important aspect of the U.S. trade deficit: aging populations in other countries. This means that the ratio of working adults to pensioners (or dependents) will be falling, which in turn means those countries had better do lots of saving now. This is true of the U.S. too, but we have less of a problem than most countries, including places such as China, which are thriving now partly because they have few retired people relative to productive people. The U.S. is a safe place to invest, too, and so foreign investment in the U.S. exceeds U.S. investment abroad. Foreign investment in the U.S. cannot be greater than U.S. investment abroad unless the U.S. runs a trade deficit. And so we do. In Pettis' words,As Europe ages and its population declines, there will be enormous pressure to break the social model. Rising demands from pensioners, greater expenditures on health, increased military spending, and various other costs will have to be provided by a rapidly declining work force.A reasonable long-term protective strategy might be to increase current European and Japanese claims on foreign economies in order to make the future adjustment process easier. Over the next decade, Europeans and Japanese would have to save as much as possible and use these savings to accumulate claims abroad. As their foreign claims accumulate while economic conditions are (relatively) good, they will be able to draw down on these claims to pay for the import of goods and services that they will need during their great adjustment periods....

With demographic crises threatening not just Europe and Japan, but also Russia and China, it makes sense for threatened countries to accumulate claims against the only part of the world economy that seems healthy and large enough to help the adjustment process. Of course, the only way to accumulate such claims is by running significant current-account surpluses against the U.S.

Permalink: 09:17 AM | Comments (2) | TrackBack

January 10, 2005

Student Loans-- Becker and Posner, Investment vs. Consumption

The Becker-Posner blog has an interesting discussion of student loans (see Becker and Posner), inspired, I bet, by a WSJ article I read today or yesterday giving sob stories of people pressed to repay the government money they took and used for education.I am surprised that neither Professor Becker nor Posner highlight the crucial difference between home mortgages and student loans: student loans are profitable for the borrower, but home mortgages are not. (Both are, technically, investment, but a home loan is investment only in the sense that it pre-pays for housing consumption.)

This strengthens Becker's point that people would be willing to take out large student loans since they are willing to take out even larger mortgages. The student loans, unlike the mortgages, actually increase the borrower's ability to repay, by increasing his future income.

This weakens Posner's point that if lack of bankruptcy protection is appropriate for student loans, it ought to be appropriate for mortgages too. One reason it makes a difference is that we might think that because of consumer ignorance or transaction costs the default rule should be bankruptcy protection for consumption loans but no bankruptcy for investment loans. Why, then, would education investment be different from, say, investment in apartment houses? -- Because the purchased capital can be used as security if it is an apartment building instead of an improved brain.

Of course, not all student loans are for investment. Some do *not* increase earning ability-- maybe. Loans to people getting B.A.'s in English come to mind. But, first, I'm not sure such a degree doesn't have a high material return. If you looked at English majors 20 years down the line, I would not be surprised if you found they had, on average higher incomes than business majors. The reason is not necessarily that English is so useful in making money, but that it may be that the kind of people who major in English are those with the intellect and family background to be successful in business.

Second, I think it would be appropriate to deal separately with education that does not have the high material return that most education does. The easy justification for most government-aided student loans is that they are loans that have positive return to the borrower, and are merely filling in for market failure arising from bankruptcy. This is Becker's main point-- that this is legitimate, but it doesn't need any government subsidy on top of special repayment rules. The more difficult justification is that even non-income- generating education has positive externalities. That may be true, but it surely depends on the type of education. If so, we should target the subsidy to the externality-generation kind of education. Training to become a research scientist has positive externalities; training to become a diesel mechanic probably doesn't.

Permalink: 10:12 PM | Comments (0) | TrackBack

January 07, 2005

Corporate Share of GDP; Who Owns Stock?

The 2003 Economic Report of the President, Chapter 2, is quite good on corporate governance. It starts with some interesting facts:Corporate governance is the system of checks and balances that guides the decisions of corporate managers. As such, it affects the strategy, operations, and performance of business firms over a large segment of the economy: corporations during 2001 accounted for 60 percent of U.S. gross domestic product (GDP). Corporate governance also affects the ability of those outside the corporation---including investors--to monitor the quality of management and its decisions and to influence and even control some of those decisions. This observability, or transparency, can greatly enhance a corporation’s ability to raise funds from outside investors. It can also make it easier for other outsiders, including suppliers and customers, to transact with the corporation, by making the incentives and abilities of its managers and other employees more clear.Another interesting fact, from Chart 2.4, is that now institutions (pension funds, insurance companies, etc.) hold 49% of stock, compared to 7% in 1951. Much of the increase (15% to 31%) occurred from 1965 to 1971, and by 1986 the figure had reached 43%.Households increasingly participated in the ownership of corporate stock during the 1990s. Fewer than one-third of U.S. households--31.6 percent-- owned corporate stock directly or indirectly in 1989. By 1992 that number had grown to 36.7 percent. More than half--51.9 percent--of households owned stock as of 2001, the latest year for which comparable survey statistics are available.

Permalink: 12:10 PM | Comments (0) | TrackBack

January 04, 2005

REPEC List of Top Economists

REPEC has a very interesting list of the top 5% of the authors in their web collection of papers by about 6000 economists (the top 5% is about 300). I used to be in the top 5%, I think, but I fell to the 93rd percentile earlier this year.Some names I don't recognize are: Kirby Adam J.R. Faciane (7), Christopher Baum (11), Bruce Smith (18), Nicholas Cox (19), Ross Levine (24), M. Carmen Guisan (27), and Pablo Fernandex (29). Perhaps I should take a look at their work.

Permalink: 07:52 PM | Comments (1) | TrackBack

December 23, 2004

Why Doesn't the City Shovel my Sidewalk?

We've had 16 inches of snow over the past couple of days. My wife asked me a good question yesterday:Why doesn't the City shovel our sidewalk when it snows?

The City wants the sidewalks cleared of snow; Bloomington just strengthened its ordinance requiring property owners to shovel their walks. The fine is $75 now, I think. Why do cities generally (always?) require citizens to shovel the sidewalks rather than taxing them and having it done my machinery?

Note that cities do not require citizens to plow the streets in front of their property.

One reason is that shovelling the sidewalk is not too onerous for the property owner. He has his driveway and front steps to shovel anyway, so he has a shovel or a snowblower (as appropriate to his property and latitude) already.

But there would still be economies of scale in having the city do it.

I bet in some subdivisions the neighborhood association hires someone to plow the walks, just as in some of them the lawns are mowed for the owners (who pay a sort of tax for it).

In most cities any ordinance the city has requiring shovelling is not enforced. Maybe the result is that people only plow if it is efficient to do so, because of traffic in front of their home and their own desire for a cleared sidewalk. If the city did it, the city, with less information, might plow everywhere, including places where it does not matter.

But that answer does not satisfy me.

Permalink: 08:45 AM | Comments (1) | TrackBack

December 21, 2004

Iraqi Gasoline Shortages and Opportunity Cost

From The Economist, , via Marginal Revolution, we learn why there are gasoline shortages in oil-rich countries.THE queue of angry motorists stretches for miles. Baghdad's petrol stations are drier this month than they have been since just after the American-led invasion of Iraq in 2003. Some drivers wait for as much as 24 hours, sleeping in their vehicles. When told that there is no petrol, some have lost their tempers and started shooting. How, asks a furious driver, can an oil-producing country run out of fuel?In an oil-rich country, people expect gasoline to be cheaper, even though its value is just as high as in an oil-poor country. This is a good example of the idea of opportunity cost. If Iraq could not export oil, gasoline would be very cheap there. But it can, so gasoline should be priced at the world level. The opportunity cost of burning up a gallon of gasoline in your car in Iraq is that that gallon can't be sold on the world market.Ask an insurgent, and he will assure you that the American army steals the oil for its tanks. Others might blame the lack of capacity at Iraqi oil refineries or the fact that the insurgents keep blowing up the pipelines. But the most important reason is that the government has fixed the price of petrol at approximately zero--barely one American cent a litre.

ShortageOfficials and petrol-station owners with access to subsidised petrol have a choice. They can do the proper, legal thing and give the stuff away. Or they can let it leak onto the black market, where prices are between ten and 100 times higher. Or they can smuggle it out of the country where, global oil prices being rather steep at the moment, it sells for a tidy sum. ...

In ten minutes, a guerrilla can scrape back a few inches of dirt, uncover some pipe, attach a bomb made from one of the country's abundant abandoned artillery shells, and thereby wreak havoc in Baghdad. Between August and October this year, pipe-raiding by terrorists (and oil thieves) cost the country $7 billion in lost revenues, says the petroleum ministry.

Subsidised petrol in Iraq is a hangover from the Saddam era, but two changes have made the system unworkable. One is that more Iraqis now seem to have cars than under Saddam. The other is that the country is more lawless....

Saddam's regime used to pay tribes to protect the pipes on their land. American and Iraqi officials have followed suit, but sometimes find that if they pay one tribe, a rival blows up the line and then claims to be more deserving of the protection money.

Permalink: 10:24 AM | Comments (0) | TrackBack

December 20, 2004

Countries to which the U.S. Exports Beef

The U.S. Dept. of Agriculture tells us that the top countries for U.S. beef and veal exports in 2003, in millions of dollars, wereJapan 1166 Korea 749 Mexico 604 Canada 321 Taiwan 70I came across this kind of number in a student paper and was surprised by Korea's high position. I was struck in my short visit there, though, at how much meat was sold by street vendors and in restaurants compared to in Japan.

That Japan is so high is no surprise. Mexico and Canada are close and trade is free. Europe might show up on the list if it allowed free trade in agricultural goods.

Permalink: 09:26 AM | Comments (2) | TrackBack

December 17, 2004

Economagic Charts: The Inflation Rate

I am browsing through data sites for next semester. Free stock and macro data is well represented on the Web, but business data is a little harder to come by, except in the fee-based services to which my university subscribes.

One good site for macro data is

Economagic, which allows easy

construction of Gif charts like the

inflation one I've put here.

One good site for macro data is

Economagic, which allows easy

construction of Gif charts like the

inflation one I've put here.

It's interesting how the monthly rate zigs and zags. Is this measurement error-- that when one month is high due to positive measurement error, the next is low due to negative error? Or, perhaps, Fed corrections? This is the sort of things time-series econometricians study, and they no doubt have answers.

Permalink: 10:20 AM | Comments (1) | TrackBack

December 14, 2004

The Long Tail: Book Sales of Hits vs. Low-Volume Titles

From a Wired article on internet sales and how titles that are not hits are still profitable, "The Long Tail":...The average Barnes & Noble carries 130,000 titles. Yet more than half of Amazon's book sales come from outside its top 130,000 titles. Consider the implication: If the Amazon statistics are any guide, the market for books that are not even sold in the average bookstore is larger than the market for those that are...Demand is being diverted from the most popular titles to this "long tail". Is that good? The economist's answer is "yes". If people are given to fads, it is even better. The only cause for discomfort is that if it is the "maximum" of creative output that is the most valuable for a society, our maxima, in terms of popular appeal, are going to be less rewarded.

Permalink: 08:35 AM | Comments (1) | TrackBack

December 09, 2004

Gross State Product Statistics

I happened across a table of Gross state products from the BEA, Dept. of Commerce. Here are a few, from 2001, in millions of dollars (so US GNP is about 10 trillion, and Vermont is 19 billion)US 10,137,190 Alaska 28,581 California 1,359,265 Florida 491,488 Illinois 475,541 Indiana 189,919 New York 826,488 Texas 763,874 Vermont 19,149 Wyoming 20,418California is 13% of American GDP, which makes it more important than most countries.

Permalink: 08:56 AM | Comments (0) | TrackBack

December 01, 2004

The Banana War Continues-- Protectionism in the EU

I'm teaching about the Banana War today-- a trade conflict between the EU on the one side and the US and Latin American countries on the other. As this 2001 article says,On 11 April, the US Government and the European Commission reached an agreement to resolve their long-standing dispute over bananas. Under the accord, the EC will abandon its contentious first come - first served (FCFS) import system of bananas in favour of a new regime that will provide a transition to a tariff-only system by 2006. Washington argued that the FCFS favoured banana growers in former European colonies over Latin American producers and US marketing companies such as Chiquita Brands International. Until 2006, bananas will be imported into the EU market through import licenses distributed on the basis of past trade as pushed for previously by the US (see BRIDGES Weekly, 10 April 2001). In return, the US will suspend sanctions it imposed on US$191 million worth of EU exports following a WTO ruling that declared the EC banana import policy in violation with world trade rules.The dispute began in 1994 with an obviously illegal quota system introduced by the EU to benefit former colonies and--less noticed-- European banana companies, at the expense of European consumers (especially German ones), American banana companies, and Latin American banana growers. The Latin Americans brought a GATT complaint and won; the US had a Section 301 complaint, then there was a WTO complaint... At every stage, the EU lost, but kept the quotas until 2001. Even now, it has the quotas till 2006, and I've read it has recently proposed new tariffs that would be even more protectionist than the quotas were! As Senator Grassley writes,

... I am extremely troubled by the announcement on October 27, 2004, that as of January 1, 2006, the European Union will impose a tariff of 230 euros per metric ton on banana imports that do not originate in African, Caribbean, and Pacific ("ACP") countries.... Now, you don't have to be a trade lawyer or an economist to see that increasing the MFN duty on bananas by over 200 percent will not serve to maintain total market access for MFN banana suppliers. In fact, it will have exactly the opposite effect. One study estimates that a 230 euro tariff will reduce banana exports from Latin American suppliers by over one-third, resulting in lost income of about $400 million per year and over 75,000 job losses. That is not the outcome envisioned by the United States when we agreed to the Understanding and when we consented to the WTO waiver.As with the US steel tariffs, the lesson is that even with the WTO, if countries want to break the rules, they'll break the rules. The US broke them for steel for a couple of years; the EU has for bananas for 10 years now.

Permalink: 10:48 AM | Comments (0) | TrackBack

November 26, 2004

Fall in Health Costs: Eye Laser Surgery, an Uninsured Item

Alex Tabarrok has a good post at Marginal Revolution on how one kind of health care cost has actually fallen:Laser eye surgery has the highest patient satisfaction ratings of any surgery, it has been performed more than 3 million times in the past decade, it is new, it is high-tech, it has gotten better over time and... laser eye surgery has fallen in price. In 1998 the average price of laser eye surgery was about $2200 per eye. Today the average price is $1350, that's a decline of 38 percent in nominal terms and slightly more than that after taking into account inflation.I don't know that there hasn't been decline in the price of other procedures-- or every procedure-- as they become better known, but this is still a striking example of how competition drives down price.Why the price decline in this market and not others? Could it have something to do with the fact that laser eye surgery is not covered by insurance, not covered by Medicaid or Medicare, and not heavily regulated? Laser eye surgery is one of the few health procedures sold in a free market with price advertising, competition and consumer driven purchases.

There is another example of falling health costs which is so obvious one might miss it: the fall in the price of drugs when their patents expire. One reason to be nervous about the Bush Medicare drugs bill is that pharmaceuticals have been such a successful part of health care.

Permalink: 10:27 AM | Comments (0) | TrackBack

November 22, 2004

Three Theories of International Trade;Hummels Paper

Professor Hummels visited here Friday and taught me a few things. Here are some notes from a paper of his, Hummels \& Klenow's "THE VARIETY AND QUALITY OF A NATION'S TRADE":Gallup, Sachs and Mellinger (1998) find that a country's access to navigable waterways is strongly related to its trade and development. Gallup, Sachs and Mellinger (1998), "Geography and Economic Development," NBER Working Paper #6849, December.

Frankel and Romer (1999) find that distance from other economies is very negatively related to its trade and per capita income. Frankel, Jeffrey and David Romer (1999), "Does Trade Cause Growth?," American Economic Review 89(3), 379-399.

Professor Hummels gave a seminar here, and explained part of the paper to me. Suppose a large country expands its exports. Three things might happen:

1. Products are homogeneous, and each firm produces more. This reduces the price they can get on the world market. This is the traditional, 1960's trade model.

2. Products are differentiated horizontally-- by variety. When prices start to fall with increased output, it becomes more profitable to start producing new products. So prices don't fall- they stay the same. This is the Krugman-style, monopolistic competition model.

3. Products are differentiated vertically-- by quality. When prices start to fall with increased output, it becomes more profitable to start producing a higher-quality product. So prices don't fall- they rise (though costs rise too). This isthe model of Hummels and Klenow.

Permalink: 02:50 PM | Comments (0) | TrackBack

November 17, 2004

Risk Aversion-- Gollier Table to Check Your Own Level

What percentage of your wealth would you give up to

eliminate a risk of losing 10% of your wealth? Less than

10%, of course, but how much less? The table below, from

Table 2.1 of Christian Gollier's The Economics of Risk

and Time, says what your "relative risk aversion"

coefficient is if you have constant relative risk aversion

utility.

Relative risk aversion 10% risk 30% risk

.5 .3% 2.3%

1 .5% 4.6%

4 2% 16%

10 4.4% 24.4%

40 8.4% 28.7%

If you would give up 2% of your wealth to avoid a 50-50

risk of losing or gaining 10%, then you have a coefficient

of relative risk aversion of 4. That's about where I am, I

think, for the 10% risk. That implies, though, that I would

give up 16% of my wealth to avoid a 30% gamble, which I'm

less sure about.

One of the hard things in doing this kind of

introspection is that it matters how we define "wealth". It

matters whether it is lifetime wealth (including the value

of my human capital-- the wages I can earn) or just the

amount of wealth I have in hand right now. If I lost 30% of

my non-human capital this year, that would not be nearly so

serious as if I lost 30% of the value of my future wages.

The cleanest theoretical model is to think of lifetime

wealth, and we all make our investment decisions based on

that. But, knowing, for example, that we can fall back on

our wages, and that we can modify our investment policy in

case of disaster, we can look very risk-loving with respect

to our investments.

Permalink: 01:34 PM | Comments (0) | TrackBack

November 15, 2004

Franchising in Brazil

Update, Nov. 17: My old link to the quote went bad. I think this one is to the same report, in pdf: report on U.S. trade with Brazil:

I just came across the interesting fact that franchising has been highly successful in Brazil.

After nearly two decades of success in Brazil, the franchising system continues to boom. As of 2002 it accounted for 25% of the gross revenue in the retail segment with around 800 franchise chains and 56,000 franchise units, divided into approximately 30 business segments, generating over 350,000 jobs. ...

Between 2001 and 2002 the Brazilian franchising system boasted more than eight billion dollars in sales. According to ABF, the continued growth of franchising in this market has strengthened Brazil's franchising system to such that it is now one the world's third strongest, outranked only by the United States and Japan.

According to local sources, the continued success of the Brazilian franchising system is in part due to the increase in participation of already consolidated businesses exploring alternative avenues of expansion. Local Brazilian companies form the vast majority of franchises in Brazil (about 90%), however, foreign groups, particularly from the U.S., are making their way into the market too.

Strict regulations preventing foreign franchises from remitting royalties to their headquarters contributed to the dominance of Brazilian franchises over their foreign counterparts. However, the reform of the Franchising Law in 1994 has granted greater investing opportunities to foreign franchises. Foreign franchises are now allowed to remit royalties to their countries of origin. However, U.S. franchisors must adapt to meet required market norms and standards, invest in market research, test market receptivity through pilot projects and adjust their concepts to Brazilian business practices and consumer tastes. In Brazil, franchise consultants refer to this process as the "tropicalization" of the franchise.

This sounds like an opportunity for businesses in other Third World countries.

Permalink: 08:49 AM | Comments (1) | TrackBack

November 12, 2004

Marsh and McLennan Insurance Brokers: Common Agency

I gave my options paper at Georgia State this week at their

department of risk (a neat idea for a department!), and

talked with some people about the Marsh and McLennan scandal. Marsh is a very large

insurance broker, which companies such as Delta Airlines

hires to find the best insurance deal for them. Marsh was

engaged in fraud, it seems, but another practice, more

common and perhaps defensible, was that it took commissions

from both sides of the transaction-- from the client, Delta,

and from the insurance company that got Delta's business.

Moreover, the commission from the successful insurance

company was based on the ex post profitability of its

contract with Delta, I was told.

Could there be an efficiency reason for this "common

agency" problem-- in which the agent, Marsh, tries to

satisfy two principals, Delta and the insurance company?

Maybe. Our first thought is that this is simple corruption--

that Marsh is supposed to be acting just on behalf of Delta,

but secretly takes bribes from the insurance company. But

can we imagine a situation in which the "kickbacks" or

"commissions" to the insurance company are known to Delta,

but Delta still wants to hire Marsh?

Here is a possibility. Suppose Marsh's function is to

warrant that an insurance customer is a customer worth

having--that it has no hidden costs for the insurance

company. When Marsh says that a customer is a "good

customer", the insurance company gives the customer a low

price for insurance, but asks Marsh to back up its claim by

accepting a financial penalty if the customer turns out to

be a "bad customer", by agreeing to take 10% of the profits

from the insurance contract. If the customer is bad, that

10% amounts to nothing; if the customer is good, Marsh gets

some money. Marsh would then accept only good customers,

and good customers would agree to this, because it is a way

they can prove they are good to insurance companies.

I don't know enough about Marsh's particular situation

to know if this fits it, and formal modelling might show up

some inconsistency in my story, but it has at least slight

plausibility.

Permalink: 02:34 PM | Comments (0) | TrackBack

November 10, 2004

Who Paid the 9-11 Costs?

RiskProf reports on a RAND Corporation study of who paid compensation for 9-11 damages. Of th 38.1 billion dollars that they quantify, 51% was paid by insurance companies, 7% by charity, and 42% by government. An interesting question is whether the high amount of non-insurance compensation will cause people to rely less on insurance.

RiskProf reports on a RAND Corporation study of who paid compensation for 9-11 damages. Of th 38.1 billion dollars that they quantify, 51% was paid by insurance companies, 7% by charity, and 42% by government. An interesting question is whether the high amount of non-insurance compensation will cause people to rely less on insurance.

Permalink: 06:10 PM | Comments (0) | TrackBack

November 04, 2004

"Recycling is garbage" by John Tierney (1996)

John Tierney's well-crafted ``Recycling Is Garbage," New York Times Magazine, June 30, 1996, states the case against recycling very well. Recycling can, of course, be a good idea, but only when it is profitable. City programs lose money, and when people spend time sorting garbage, it is a waste of resources, not thrift. If you simply throw all your recyclables in one garbage can and your other garbage in another, private labor costs are small, but the city still must pay extra. If you must sort carefully, home labor costs become the biggest part of the cost.

Here are extensive excerpts, reformatted by me and without ellipses, for the most part:

The simplest and cheapest option is usually to bury garbage in an environmentally safe landfill.

Since there's no shortage of landfill space there's no reason to make recycling a legal or moral imperative.

Mandatory recycling programs offer mainly short-term benefits to a few groups -- politicians, public relations consultants, environmental organizations, waste-handling corporations -- while diverting money from genuine social and environmental problems.

Recycling may be the most wasteful activity in modern America: a waste of time and money, a waste of human and natural resources.

[of Charles City Council, which imports New York City garbage to its landfill] ... thanks to its new landfill, the county has lower taxes, better-paid teachers and splendid schools. The landfill's private operator, the Chambers Development Company, pays Charles City County fees totaling $3 million a year -- as much as the county takes in from all its property taxes. The landfill has created jobs, as have the new businesses that were attracted by the lower taxes and new schools. The 80-acre public-school campus has three buildings with central air conditioning and fiber-optic cabling. The library has 10,000 books, laser disks and CD- ROM's; every classroom in the elementary school has a telephone and a computer. The new auditorium has been used by visiting orchestras and dance companies, which previously had no place to perform in the county.

Why should New Yorkers spend extra money to recycle so they can avoid this mutually beneficial transaction?

Why make harried parents feel guilty about takeout food?

Why train children to be garbage-sorters?

Why force the Bridges school to spend money on a recycling program when it still doesn't have a computer in the science classroom?

Are reusable cups and plates better than disposables? A ceramic mug may seem a more virtuous choice than a cup made of polystyrene, the foam banned by ecologically conscious local governments. But it takes much more energy to manufacture the mug, and then each washing consumes more energy (not to mention water). According to calculations by Martin Hocking, a chemist at the University of Victoria in British Columbia, you would have to use the mug 1,000 times before its energy-consumption-per-use is equal to the cup. (If the mug breaks after your 900th coffee, you would have been better off using 900 polystyrene cups.)

When consumers follow their preferences, they are guided by the simplest, and often the best, measure of a product's environmental impact: its price.

Polystyrene cups are cheap because they require so little energy and material to manufacture -- without reading a chemist's analysis, you could deduce from the cup's low price that it's an efficient use of natural resources. Similarly, the prices paid for scrap materials are a measure of their environmental value as recyclables. Scrap aluminum fetches a high price because recycling it consumes so much less energy than manufacturing new aluminum. The low price paid for scrap tinted glass tells you that you won't be conserving valuable resources by recycling it. While price is hardly a perfect measure of environmental impact, especially in countries where manufacturers are free to pollute, an American product's price usually reflects the cost of complying with strict environmental regulations.

Permalink: 03:22 PM | Comments (2) | TrackBack

November 01, 2004

Bates College Students Buying Pollution Permits

I'm teaching pollution control methods today, and came across this interesting story about

Bates College econ students buying and retiring sulfur dioxide permits:

In 2001, 2002 and 2003, at the rate of one permit per year, students in the "Environmental Economics" course at Bates bought and retired government permits for the atmospheric release of a pollutant that causes acid rain.

This year, in one fell swoop, the 49 students in Econ 222 quadrupled the amount of sulfur dioxide (SO2) that Bates is keeping out of the nation's air. A $1,200 challenge grant from an environmental organization in Colorado spurred the students to submit winning bids for nine permits in the annual U.S. Environmental Protection Agency SO2-allowance auction....

...The Bates students bid $292 for each of the permits in this year's auction, held March 22....

"He asked if our class could match his $1,200 and buy a total of eight permits, as well as educate others about the program," Lewis explains. "My students designed informational fliers, sold T-shirts that they designed and had a booth in Commons," the college's dining hall.

Several campus organizations and many individuals at Bates contributed to the grant-matching drive. "We sold SO2 by the pound," Lewis says. "Five pounds for a buck -- you can't beat that!" In the end, the students even came up with enough money to top Udall's challenge by one permit.

I'm not sure that there is really that much social value to reducing sulfur dioxide pollution further, but I applaud the exercise in learning about property rights-- and in using your own money to control pollution rather than political power.

Permalink: 05:52 PM | Comments (0) | TrackBack

October 18, 2004

The Economics of an Altruistic Utopia

Imagine the following utopian economic system. Everyone is instructed to provide goods and services for other people if so doing is efficient-- that is, if the cost to themselves is less than the value to the other person. Let us assume that everyone does his sincere best to comply. Thus, instead of paying for groceries, the grocer will provide the groceries he thinks efficient for free, but the customer will not take any groceries unless he thinks the value to himself is greater than the cost of production. ...

... Such a system would run into immediate trouble because of information problems. How is the grocer to know what goods the customers want, so he can stock up? He can observe which goods disappear from his shelves, but that only shows which goods the customers *think* cost less than the benefit to themselves. How are the customers to know which goods have a benefit to themselves greater than the cost to the grocer? Without prices, they have little idea of the cost-- of whether salmon is cheaper to produce than steak, for example.

Thus, such a system would need prices anyway, just for information. Could it operate with prices, but without actually charging people? That would be an improvement over the no-price system. We could, for example, auction off a rare painting, awarding it to the highest bidder, but not make the highest bidder actually pay. Under our assumption that everyone is honest, the auction would reveal willingness to pay accurately.

In the grocery store, we would have the grocer acting as if he was profit-maximizing, even though he was altruistic. He would, for example, raise the price when demand increased for a good, so as to make sure that everyone would know to take it only if it were particularly valuable to them.

For goods and services, would altruism help efficiency to any considerable extent? It is hard to see how it would hurt, because an altruistic society could just imitate a selfish one, but it sounds like that might be what would happen. Otherwise, altruism simply requires too much information.

Permalink: 11:10 AM | Comments (0) | TrackBack

October 17, 2004

Planned Economies and Free Trade

In response to an April post arguing that welfare states should not mind free trade, J. N. suggested to me that intrusive states would dislike free trade because it creates unpredictability. That is an interesting idea.

Which kinds of states need predictability? Ones with lots of planning and rigid regulations, I guess. Intrusiveness per se is not it-- I don't think a moralistic theocracy would be especially concerned about an unpredictable economy. But a state with a 5-year-plan, that uses Authority rather than Prices for coordination, would be disrupted by uncertain trade flows. Similarly, a state that uses price controls would find things not working out as planned.

This would also extend to economic growth. If economic growth involves unpredictability-- say, in which sectors are gaining in employment-- it would mean that having a price-based, flexible system is more important. A non-price system would be more willing to give up some growth if it could thereby get rid of some uncertainty.

I've forgotten how it works in Weitzman's old RES "Prices Vs. Quantities"article works, but that might be relevant.

Permalink: 04:34 PM | Comments (0) | TrackBack

Behavioral Economics

I recently blogged on the Trust Game or Investment Game. J. O.N. refers me to this Newsweek article on it. Some people in "behavioral economics" like to say that people are not economically rational. What I think is more correct is to say that people do try to maximize utility but 1. People make a lot of dumb mistakes, and 2. People have moral preferences as well as material ones.

Why trust someone to whose material advantage it is to take your money and return you nothing? It could be a dumb mistake-- not realizing that they could take advantage of you. That's why investment scams work. Or it could be that you are relying on the fact that most people are moral, to at least a small extent, and would feel guilty if they did not return anything to you. Sometimes the gamble will work out, sometimes it won't.

There's nothing in economics that says all preferences have to be for material consumption. In fact, that would be a hard position to make coherent, since what we really consume are particular sensory outputs of material objects (think of the old Kelvin Lancaster idea of utility over characteristics, used in hedonic regressions of how valuable a car is in terms of speed, acceleration, roominess, etc.) It is no more objectively rational to pay a $100 to hear some music waft across a concert hall than to pay $100 to go to the concert hall to impress someone else with my good taste, or to pay the $100 to subsidize musicians because I like them. And, getting back to mistakes, I and everyone else might have paid the $100 thinking I'd hear nice melodies but we get Schoenberg instead, and regret it.

The biggest ideas in economics are, I think, markets, incentives, and efficiency. All these apply to situations where there are mistakes and nonmaterial preferences. Raise the price of an activity, and people will do less of it is the usual rule, and a very powerful idea. That applies to all the concert examples above-- if I have to pay $200 to get teh same effect (including to benefit musicians by $100), I may well decide not to go to the concert.

Permalink: 04:11 PM | Comments (0) | TrackBack

October 15, 2004

Are Economists Selfish? The Laband-Beil Association Dues Study

I just read "Are Economists More Selfish than Other 'Social' Scientists?" by David Laband and Richard Beil (Public Choice, 1999, 100: 85-101). They looked at lying by members of the American Economic Association, the American Sociological Association, and the American Political Science Association. Each association has higher dues for members with higher incomes, so if you lie and say your income is low, you save on your dues. Laband and Beil surveyed members about their incomes, and then compared the income distribution to what members reported when paying their dues. Page 96 has the result: in the category of incomes above $50,000, it seems that 26% of political scientists underpay dues (15.3/60.6 from Table 2), 33% of economists, and 50% of sociologists. More economists earn high incomes, so the actual numbers of cheating high-income economists and sociologists look about the same. But the sociologists also have more cheating of middle-income members saying they are in the low-income bracket. Laband and Beil have a clever single summary statistic: an estimate of the percentage of dues not collected because of cheating. The amount lost by cheating is 7% for the economists, 9% for the political scientists, and 22% for the sociologists. The implication seems to be that studying economics or politics does not make people more selfish or dishonest, but sociology is bad for one's morals.

Permalink: 10:11 AM | Comments (0) | TrackBack

September 25, 2004

The Predictions of Prediction Markets

Manski has an Econometrica article about markets like the Iowa presidential market where people trade on probabilities of events happening. If the market price of a Bush contract paying $1 if he wins is .70, does that mean the market puts a 70% probability on a Bush victory? Sort of, but not really. Michael Stastny writes at MR:

On TradeSports a contract of George Bush in the winner-take-all market is currently selling for around $7. But what does this actually mean? Most traders and researchers would argue that 0.7 is the current "market probability" that the event "George Bush wins the 2004 presidential election" occurs. But this answer drives Charles Manski, an economist who recently also published an article in the September issue of Econometrica, crazy.

He says that under not-so-far-fetched assumptions, the price of a contract reveals nothing about the dispersion of traders' beliefs and partially identifies the central tendency of beliefs. A President.GWBush2004 contract trading at 70 reveals that 70 percent of traders believe the probability of the event "George Bush wins the 2004 presidential election" to be larger than 0.7. The mean subjective probability of this event lies somewhere in the open interval (0.49, 0.91) (price/mean belief region).

Alex Tabarrok at MR and posts at Bainbridgeand Deadparrots and probably elsewhere discuss this too. I haven't read it all, or even glanced at Manski's article, but here are some thoughts on how Manski's idea might work.

Suppose all traders have identical wealth and are risk neutral. Each will then bet his entire wealth based on his belief that Bush will win the election. Start with the simple case of two kinds of traders. Suppose 30% think Bush has 0 chance of winning, and 70% think he has 100% chance of winning. The mean market belief will be .70. When the dust settles, each side having bet all its wealth, the price of a George Bush contract in this market will be 70.

But this same result would have occurred if 30% think Bush has 0 chance of winning, and 70% think he has 70.001% chance of winning. For the Bush Optimists, a contract at 70 is still a good deal. But now the mean market belief is .49.

Or, suppose 30% think Bush has .6999 chance of winning, and 70% think he has 100% chance of winning. For the Bush pessimists, a contract at 70 is still a good deal (to sell--not to buy). But now the mean market belief is .91.

Notice that market behavior is based on *inequalities, not equalities*. What matters is whether the market price is lower than my subjective belief, not how much lower.

Thus, a market price of 70 just indicates a mean market belief between .49 and .91. That includes my first case, where the mean market belief is exactly .70, but also includes a lot of other ground.

This works because I have chosen the most extreme possible market belief dispersion-- lots of 0's or 100's. I've also assumed risk neutrality and identical wealths, but those are the reasonable assumptions. It is obvious that if all the 100% Bush Optimists have no wealth or are extremely risk averse then they will not bet even though they think they'd win, and so they would have no effect on the market price.

Permalink: 09:08 AM | Comments (3) | TrackBack

September 21, 2004

Selling Your Spot in Line-- Canadian Knee Operations

Alex Tabarrok at MR has a post I'll use in my class tomorrow, since we are discussing property rights and the problem of defining "property":

The Canadian health care system is falling apart. Bill Binfet needs both knees replaced. He waited 4 months to get an appointment with a specialist who then put him 290th on a waiting list. It's been a year and still no surgery despite the fact that his arthritis is now so bad he has bone grinding on bone.

In desperation, Binfet has placed an ad in the local paper offering to buy someone else's place on the waiting list . The provincial health care minister tut-tuts and says "it would be unethical for a doctor to trade places on a surgical wait list for an exchange of money."...

...Of course, this is a clear improvement. The only problem I can see with allowing sale of queue spots is that people would have an inducement to get in line so as to sell their place. In this example, though, the primary care doctor acts as gatekeeper, and unless he gets kickbacks, he wouldn't let patients get in line if they didn't really need an operation.

We were just discussing a similar problem after class in G202. Apparently, Singapore would like to make rich people pay for medical care, but not poor people. It also, however, wants to avoid embarassing poor people by making them admit they are poor (don't ask if this reasonable; take it as a given of the policy making problem). This is a price discrimination problem, and the problem is to make people self-select between the high price and the low price. One solution is to use queues. People can wait in line and get the low price, or get immediate service at a high price. Another would be aesthetics-- people could go to shabby-looking, smelly (though healthful) clinics for free care, or beautiful clinics and pay a higher price.

Permalink: 10:03 AM | Comments (0) | TrackBack

September 19, 2004

The Consumer Surplus Argument for Patent Monopolies

UPDATE, Sept. 30: I see that Farrell and Shapiro mention the "profit-stealing" I discuss below, as a "well-known principle", citing Mankiw and Whinston, 1985, RJE, on entry into oligopolies.

I was just skimming Mark Lemley's working paper, "Property, Intellectual Property, and Free Riding", on the recommendations of ProfessorsSolum and Volokh. On page 39 it cites Farrell and Shapiro's 2004 working paper, "Intellectual Property, Competition and Information Technology" on the point that a patent monopoly does not reward the inventor enough. I haven't read their paper, though I know I ought to (especially since Farrell was on my thesis committee back in 1984), but I thought about the idea, and I'll write these notes for myself, weblog readers, and those three authors....

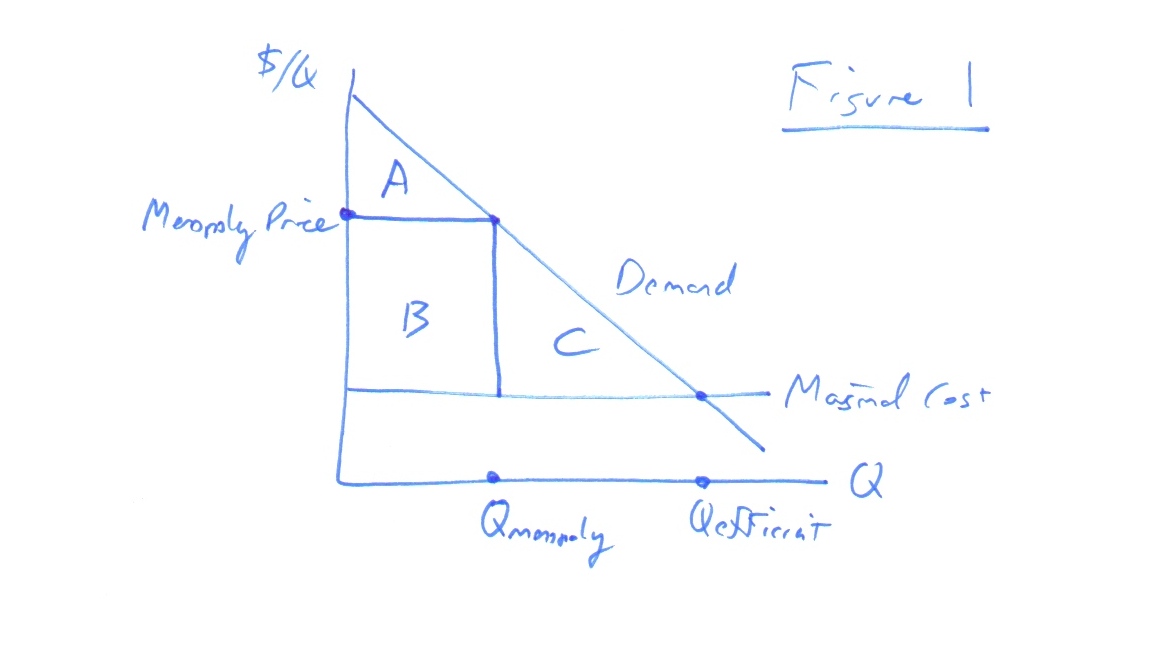

... The problem is illustrated in Figure 1. An inventor is thinking of spending amount X to invent something with the demand curve and marginal cost curve illustrated. If he did and there was no patent, then competition would force the price down to marginal cost, and although consumer surplus would be maximized, at A+B+C, there would be zero producer surplus and his net payoff would be -X. So he wouldn't undertake the research.

A patent would help. Then he would have a monopoly, and charge a price above marginal cost, earning producer surplus B. But if B is less than X, he still won't undertake the invention. Since it is possible that X is bigger than B but smaller than B+A (not mention B+A+C), patents won't yield enough profits to induce some efficient inventions.

All that is quite correct. To get the correct incentives, we need to give the inventor amount A+B+C and get the quantity of output to increase to the efficient level in Figure 1. A government bounty system might do that, some people have suggested, or government funding of research.

What makes me uncomfortable about the analysis of Figure 1, though, is that it takes the demand curve as given, and is partial equilibrium analysis. Someone must have done a general equilibrium analysis of this-- looking at an economy with two goods and finding out the incentive to invent a third good-- but I don't know of it.

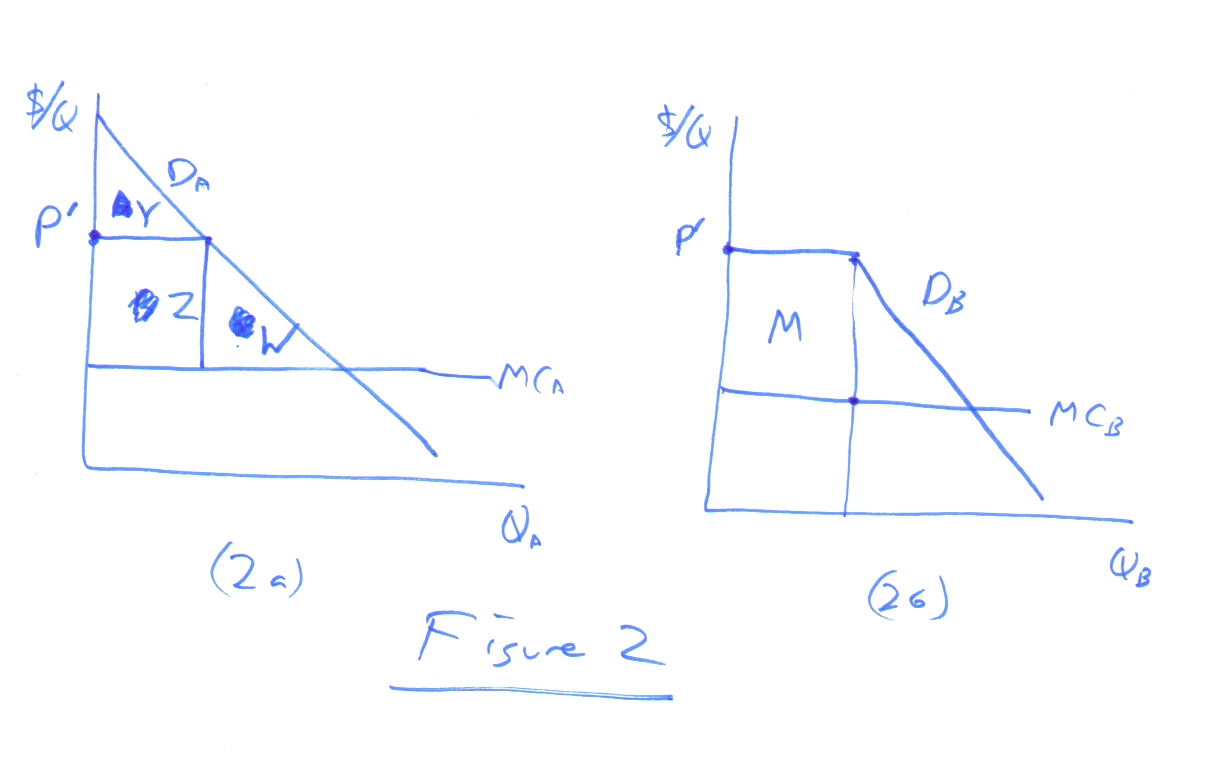

I won't do a general equilibrium analysis here, but I'll do a bit broader partial equilibrium analysis. Figure 2b looks at the same inventor who can spend X to create a new good, good B. Good B, however, is a perfect substitute for the existing good A, which has already been patented by another inventor who is charging P' for it and earning producer surplus of Z. Suppose our B-inventor pays X and gets his patent, and that the A-inventor continues to charge P'. The demand curve facing good B will then have the appearance of Figure 2b-- flat at a price of P' (since Good A is a perfect substitute) and then downward sloping at lower prices. Our B-inventor will choose a price slightly below P' and have a producer surplus of M, which, let us assume is greater than X. But consumer surplus will have risen negligibly from before the invention, and the A-inventor's producer surplus will have fallen by Z, which is just about the same size as M. Overall, social surplus will have fallen by about X-- the new invention is a social waste, invented only to transfer surplus from the A-inventor to the B-inventor. So patents give too much incentive for invention.

My analysis is incomplete, because the A-inventor will not keep charging P' when he is undercut-- the two products will settle at some lower, duopoly price, so surplus will in fact rise to the extent that output rises. But that would not change the basic conclusion: that if some of the profit from an invention is taken from reduced profits from another invention, patents can be a bad thing.

In economics one can always contrive a second-best argument like this, but this one has considerable plausibility. We are, after all, talking about an industry where one invention can occur, which makes previous patented inventions a reasonable assumption. Note that it is also an argument for short patent life, because if inventions occur with enough spacing, we won't have one monopoly stealing surplus from a previous one.

Overall, though, to return to Lemley's theme, what Figure 2 should lead us to conclude is not that patents are bad, but that we don't have as much reason to worry about inventors not getting sufficient reward as we might think after looking at Figure 1. There are other reasons along these lines too, such as Patent Races, in which competition to get the patent dissipates its value.

Permalink: 05:18 PM | Comments (0) | TrackBack

September 18, 2004

The Nature of the Firm

Professor Bainbridge of professorbainbridge.com was here yesterday to present a scholarly paper. I won't comment here on his paper, partly because it was stimulating enough that I spent a lot of time not listening to him but thinking about one of the big, classic, issues it raised: what is a firm? (I would actually pay closer attention to a boring talk, because a boring talk leaves the listener's mind completely blank, unable to do anything but keep listening in the hope that the speaker will eventually say something to make a few neurons fire off.)

... One answer might be that a firm is a collection of long-term contracts. One or more people provide capital in some long-term contract with each other, and then hire workers using long-term contracts and materials using short-term contracts.

The problem with that is that something we think of as a firm can exist for centuries without any long-term contracts at all. Consider a partnership which hires employees at will. The partners pool their capital, but are free to break up the partnership at any time. The employees are hired with the expectation that they will serve for life, and in fact they do serve for life, but they are free to quit at any time without penalty, and the firm can fire them without cause at any time. The inputs into production-- capital and labor-- don't break away, though, precisely because break-up is so easy: everybody recognizes that they had better behave or the other side of the transaction will pull out.

Rather, a firm seems to be a collection of inputs that mostly keep working together as time passes. It is like a human body-- a collection of cells that mostly keep working together, even though individuals come and go.

It is, of course, no accident that the inputs keep working together.

They might have signed a contract, of course, e.g., the capitalist agrees to pay the worker $30,000 in exchange for 8 hours per day of labor for one entire year. Note, however, that the contract is not the main thing. If both the worker and the capitalist agree, they can void the contract. If the worker gets an outside offer of $50,000, he will leave, because the worker will want the higher wage and he will pay enough to the capitalist that the capitalist will be happy to release him.

But the reason they signed the contract in the first place was that they expected it to be efficient for them to work together for a year, and the contract puts enough glue on the status quo to allow for better planning, avoid hold-up, avoid bargaining and squabbling, and make very clear the intent of each side. (It is often forgotten how useful written agreements are as simple clarifications of intent, regardless of whether they can be enforced.)

If they didn't have a contract, they might still work together for a year. They would still be a firm. The only difference is that a smaller outside offer will be able to lure away the worker. If they had a contract, an outside offer of $30,500 might be too small for it to be worth the worker's while to spend time haggling with the capitalist over his release fee. If they do not have a contract, the worker might decide to leave. But even then, the worker might stay, because an extra $500 in wages might not be worth the transition costs to him.

Coase's famous 1937 article, "The Nature of the Firm", talks about how within a firm Authority is used, whereas between firms, Prices are used to transfer resources and commands. Prof. Bainbridge noted that some people (e.g. William Klein, also of UCLA) object to this because often there is no long-term contract, and hence no legal Authority. If employment is at will, then whenever the employee dislikes an order, he can quit. I was just reading Thomas Sowell's excellent memoirs, and he gave an example: employed by Western Union as a messenger in his youth, he was told at the end of one workday to accept an overtime assignment or be fired. He had another job he needed to leave for, so he quit Western Union on the spot.

But legal authority is not the only kind of authority. Consider my firm with no contracts, just customary employment. The custom is for the worker to accept the capitalist's orders at a steady wage. Some orders are more unpleasant, and if it was a one-shot job the worker would bargain for a higher wage. But since he knows the relationship will continue, he doesn't bother. Other days the orders will be pleasant, and he will be overpaid at that same flat wage, so it all evens out. If it looks like it won't, that is when bargaining will reappear. In the meantime, though, Authority is in place, not Prices/Bargaining.

This approach does change the interpretation of Coase. Authority vs. Prices becomes Long-Term Fixed Relations vs. Short-Term Fluid Relations, rather than Legal Authority vs. Arms-Length Sales. The "law" part of it shrinks.

Permalink: 10:14 PM | Comments (0) | TrackBack

September 17, 2004

Eisner's Disney Contract: Can Boards Fire Middle Executives

Professor Bainbridge of professorbainbridge.com was here today to present a scholarly paper, about which I might or might not blog separately. Before his talk, we were discussing whether a corporation's board of directors could take the unusual action of firing a low-level employee directly, bypassing the corporation's president, rather than having to get the president to do it by threatening to fire him (or actually firing him). Think about Viacom firing Dan Rather. Or, think about how Nixon first needed the resignation of his Attorney-General then his Number Two, before Number Three finally fired the Special Prosecutor in the Saturday Night Massacre. (Number Three was Bork, who also considered resigning but was told not to by Number One and Number Two, who thought enough protest had been registered.)

Ordinarily, corporate boards can fire employees if they want to, even though it would be highly unusual to bypass the usual chain of command and micromanage. There might be contracts in the way, though. What if the president's contract says he has sole right to hire and fire lower employees? Professor Bainbridge had, on March 2, 2004, blogged on Eisner's contract with Disney. The "duties" section makes Eisner CEO....

.. 2. Duties

Executive shall be employed by Company as its Chairman and Chief Executive Officer. Executive shall report directly and solely to the Company's Board of Directors ("Board"). Executive shall devote his full time and best efforts to the Company. Company agrees to nominate Executive for election to the Board as a member of the management slate at each annual meeting of stockholders during his employment hereunder at which Executive's director class comes up for election. Executive agrees to serve on the Board if elected.

A judge would have to decide whether Disney would have breached if it had fired one of Eisner's employees, deciding whether Disney was not really employing Eisner as its CEO. It looks to me like Eisner would lose if there was just one incident, but if the board took away *all* his hiring and firing powers, that would be breach by Disney.

Another section is relevant though:

10. Termination by Executive

Executive shall have the right to terminate his employment under this Agreement upon 30 days' notice to Company given within 60 days following the occurrence of any of the following events, each of which shall constitute "good reason" for such termination:

(i) Executive is not elected or retained as Chairman and Chief Executive Officer and a director of Company.

(ii) Company acts to materially reduce Executive's duties and responsibilities hereunder. Executive's duties and responsibilities shall not be deemed materially reduced for purposes hereof solely by virtue of the fact that Company is (or substantially all of its assets are) sold to, or is combined with, another entity provided that (a) Executive shall continue to have the same duties, responsibilities and authority with respect to Company's businesses as he has as of the date hereof and as Executive may have with respect to businesses added hereafter, including but not limited to, entertainment and recreation, broadcasting, cable, direct broadcast satellite, filmed entertainment, consumer products, music, the internet, parks and resorts, etc., (b) Executive shall report solely and directly to the board of directors (and not to the chief executive officer or chairman of the board of directors) of the entity (or to the individual) that acquires Company or its assets or, if there shall be an ultimate parent of such entity, then to the board of directors of such ultimate parent and (c) Executive shall be elected and retained as a member of the board of directors of such entity or ultimate parent (if there shall be one).

(iii) Company acts to change the geographic location of the performance of Executive's duties from Los Angeles California metropolitan area.

Section 10 says that if the company "materially reduces" Eisner's responsibilities, then he is free to quit without penalty. Firing one of his major subordinates probably counts for that.

That is a sensible way to write the contract. Simply saying that the company is in breach if it fires a subordinate leads to the mess of a court having to decide what level of damages would be appropriate for the company to pay Eisner (and specifying liquidated damages is completely impractical here). Instead, the contract gives Eisner a simpler remedy-- he can quit.

Permalink: 04:52 PM | Comments (0) | TrackBack

September 04, 2004

Bilateral Monopoly Average Prices

Suppose we have 1000 buyers and 1000 sellers of a good. Let us compare the

following four situations:

1. Competition (price taking by both sides)

2. Monopoly-- the sellers cartelize, but buyers are price takers.

3. Monopsony-- the buyers cartelize, but sellers are price takers.

4. Bilateral monopoly-- both buyers and sellers cartelize, and then they

bargain, setting a quantity Q* and either a lump sum price T* or a per unit

price P*=T*/Q*....

...

Certain results are clear, if not well known.

(A) Welfare is highest under price taking and bilateral monopoly, both of which

are efficient.

(B) Sellers are best off under Monopoly or Bilateral Monopoly, depending on

their bargaining power.

(C) Sellers are worst off under Monopsony or Bilateral Monopoly, depending on

their bargaining power. (If their bargaining power is very low, they will get

practically no surplus under Bilateral Monopoly.)

Other questions need formal analysis.

(D) If bargaining splits surplus 50-50, under what conditions does the seller

prefer Bilateral Monopoly to Monopoly?

(E) How does the bilateral monopoly negotiated price P* compare with the

competitive, monopsony, and monopoly prices? In particular, can it be higher

than the monopoly price?